Optimize Your Energy Assets Cut Imbalances. Unlock New Revenue.

Inowattio transforms your industrial energy assets into active, revenue-generating participants in today's power grids.

Built for Industrial-Scale Energy Players

Our platform is engineered to meet the demanding requirements of large-scale energy stakeholders who need to manage complex assets and navigate dynamic markets.

Industrial Consumers

Earn revenue by consuming energy on demand.

Renewable Generators

Get paid to stabilize the grid by pausing generation.

Energy Storage Operators

Profit from market volatility with automated arbitrage.

Utilities & Grid Operators

Enhance grid resilience with a virtual power plant.

When the grid has too much power (e.g., on a sunny, windy day) or too little, it becomes unstable. Grid operators need to quickly increase or decrease consumption to restore balance.

INOWATTIO's platform automatically signals your facility to adjust consumption in your flexible assets for a short period. You earn revenue for providing this essential balancing service, without disrupting your core operations.

Facilities with flexible, high-capacity electrical loads, such as:

When the grid has an oversupply of energy (e.g., on a very sunny or windy day), the Transmission System Operator (TSO) needs to urgently reduce generation to maintain stability. Instead of shutting down conventional power plants, the TSO will pay renewable generators to temporarily stop injecting power into the grid.

INOWATTIO connects you to this lucrative balancing market, automatically signals your facility to curtail output when needed, and ensures you are paid for providing this critical service. This creates a valuable, predictable revenue stream entirely separate from the price you get for the energy you produce.

Developers, owners, and operators of utility-scale renewable energy assets, including:

The core of battery profitability is energy arbitrage: buying low and selling high. INOWATTIO automates this process on an industrial scale. We signal your battery to charge when electricity prices are low or even negative (during periods of oversupply). You can even be paid to charge.

Then, when prices spike, our system automatically signals your battery to discharge, selling the stored energy back to the grid for a significant profit. This cycle can be repeated multiple times a day, maximizing your revenue.

This is ideal for owners and operators of large-scale battery energy storage systems (BESS), including:

Instead of relying solely on large, centralized power plants for grid balancing, you can tap into a geographically distributed network of flexible industrial loads, renewable generators, and battery storage systems.

INOWATTIO aggregates these resources into a single, reliable Virtual Power Plant (VPP) that you can dispatch on demand. This provides faster, more granular control over the grid, reduces reliance on fossil fuels for balancing, and creates a more stable, efficient, and cost-effective energy system for everyone.

Our platform is a powerful tool for forward-thinking energy system managers, including:

One Platform. Two Value Streams.

Inowattio integrates operational efficiency with market optimization, delivering compounding value.

1. Cost Reduction & Imbalance Management

Our predictive algorithms and real-time control systems minimize deviations from your energy schedules, drastically cutting imbalance costs. We help you stay compliant and avoid costly penalties from grid operators.

2. New Revenue from Flexibility Markets

We identify and capture revenue opportunities in ancillary services, capacity markets, and other grid-service programs. Turn your operational assets into a new profit center without disrupting your core business.

Practical Use Cases

Discover how Inowattio can create value from your assets.

Fast Frequency Response

Automatically adjust power consumption or generation in milliseconds to help stabilize grid frequency during disturbances, capturing high-value ancillary service revenue.

Peak Demand Shaving

Intelligently reduce your facility's electricity consumption during peak hours to lower demand charges, one of the most significant costs on your utility bill.

Energy Arbitrage

For assets with storage (like batteries), our platform automatically charges when energy prices are low and discharges when they are high, maximizing profit from price volatility.

Voltage Support

Provide reactive power to the grid to help maintain voltage levels within required limits, a critical service for areas with high penetration of renewable energy.

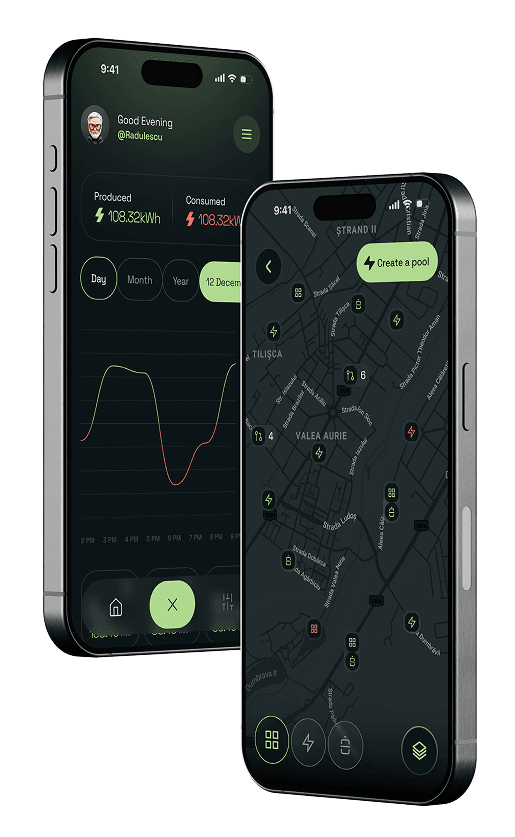

Track, Analyze, and Optimize Your Assets

Complete transparency into flexibility operations and financial performance.

Performance Dashboards

Real-time visibility into asset performance, markets, and revenue.

Earning Attribution

Full revenue transparency, down to each dispatch event.

Settlement & Reporting

Automated settlement reports for accounting and audits, with flexible export options.

Engineered for Grid-Grade Reliability

Bank-Grade Security

Encrypted communications with regular security audits and pen testing.

Cloud-Native Scalability

Microservices architecture for resilience and independent scaling.

Millisecond-Level Control

Automated control signals execute flexibility with precision.

Fail-Safe Operations

Your core processes always take priority, with full manual override.

We connect to your energy assets—be it industrial machinery, battery systems, or renewable generators—through secure, industry-standard protocols. Our system establishes a digital twin of each asset.

Our platform analyzes the operational constraints and capabilities of each asset to precisely quantify its available flexibility (e.g., ramp rates, capacity, duration).

The FlexPower engine continuously evaluates real-time market signals and grid conditions to determine the most profitable and technically feasible way to deploy your aggregated flexibility.

Once a dispatch instruction is confirmed, our system sends automated control signals to your assets, executing the flexibility provision with precision while respecting all operational boundaries.

Frequently Asked Questions

Answers to common questions about our platform and services.

Will platform integration affect our core processes?

Absolutely not. Our platform operates as a secondary control layer that always respects your primary operational requirements. We establish clear, mutually-agreed upon boundaries and fail-safe conditions before activation. Your core processes are always the priority, and you retain full manual override capability at all times.

How does the onboarding process work?

Our team of energy and control engineers guides you through a structured onboarding process. It typically involves an initial site assessment, establishing secure connectivity, asset characterization, and a pilot phase before going fully live. The timeline varies but we aim for a streamlined and efficient deployment.

Which energy markets can we participate in?

Our platform supports a wide range of markets, including frequency response (e.g., FCR, FFR), capacity markets, wholesale energy markets, and various ancillary services. We continuously add support for new markets as they emerge.

How is pricing structured for platform services?

We typically operate on a shared-savings or revenue-share model, which means we only succeed when you do. This aligns our interests with yours to maximize the value of your assets. For some deployments, a SaaS subscription model may also be available.

How secure is the connection to our assets?

Security is our top priority. We use industry-standard protocols like OPC-UA, Modbus TCP, and DNP3, all layered with TLS encryption. Our platform is hosted on secure cloud infrastructure and undergoes regular third-party security audits and penetration testing.