How It Works for Multi‑Site & Commercial Portfolios

Cut energy costs. Reduce imbalance exposure. Earn new revenue from flexibility.

Step-by-Step

Most portfolios leave money on the table in two places: they pay avoidable costs (peaks, poor schedules, imbalance charges, inefficient dispatch), and they don’t monetize flexibility (batteries, controllable loads, PV curtailment) even though the grid already pays for it. INOWATTIO connects your sites into one operational layer that optimizes consumption and generation against prices and constraints, and turns your flexibility into a “grid service” product.

Connect sites, meters, and controllable assets

Define constraints and flexibility capacity

Simulate value and select revenue streams

Optimize schedules and reduce deviations

Dispatch automatically when profitable or requested

Settle results and report savings/revenue

Where the Money Comes From

Two value streams that stack

Cost Reduction (direct savings)

You pay less for energy because we control and optimize what you already have. Typical levers:

New Revenue (grid services)

You get paid for being dispatchable when the grid needs it. Your assets become a product:

A simple explanation of the balancing market

Power systems must maintain balance in real time. When the system has too much or too little power, the operator needs fast actions. These actions are procured as balancing / reserve services.

There are also rules you must respect: response time, minimum duration, metering requirements, performance measurement, and penalties if you don’t deliver during activation. INOWATTIO’s job is to operationalize all that without breaking your core processes.

We integrate with what you already use: meters, SCADA, EMS, BMS, inverters, and controllers.

Result: A single portfolio view across all sites.

We don’t guess. We formalize constraints: power (kW), speed (ramp rate), duration, operational windows, and hard safety limits.

Result: A flexibility model that is safe and auditable.

Depending on your assets and market access, we enable combinations like peak shaving, price optimization, battery arbitrage, reserves, and curtailment programs.

Result: A portfolio strategy that fits your business, not a generic “AI optimizer”.

Every day the platform forecasts load and generation, optimizes setpoints, reacts in real time to deviations, and logs every action.

Result: Lower costs + revenue events you can audit.

For every event we produce performance proof, financial results per site/asset/event, and exportable reporting for finance/audit.

Result: Revenue and savings are transparent, not “trust us”.

How much money can we make?

Actual revenue depends on your market, asset type, and dispatch rules. But the model is always the same:

INOWATTIO can compute a business case from your historical meter data and the constraints you provide.

How INOWATTIO makes money

We don’t charge for dashboards. We charge for verified performance, revenues, and savings.

What you need (prerequisites)

If a market path is not available yet, we still deliver value through portfolio optimization, peak shaving, and imbalance reduction readiness. You’re “ready to flip the switch” when market access is enabled.

What you get day-to-day

Turn daily operations into a structured, auditable energy business — without disrupting existing assets or workflows.

Explore B2B Solutions

Tools and platforms for companies managing complex energy assets and portfolios.

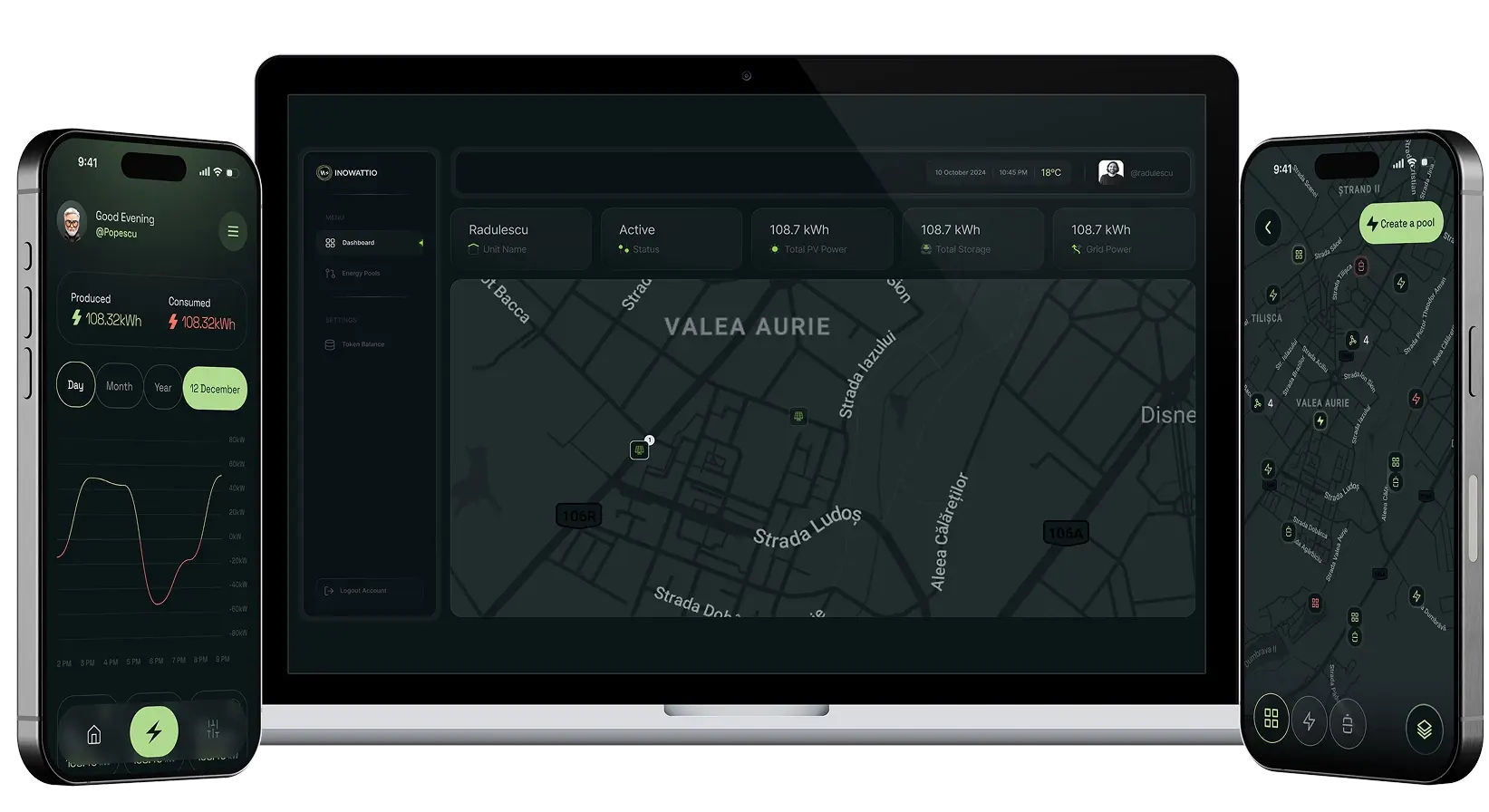

Access Inowattio Anywhere

Download the app on iOS and Android from the App Store and Google Play, and enjoy the same seamless experience on desktop as well.

Frequently Asked Questions

Answers to common questions about our platform and services.

What exactly does INOWATTIO do for an industrial site or utility‑scale asset?

INOWATTIO turns your assets (loads, PV/wind, batteries) into dispatchable flexibility and/or market-optimized resources. Practically:

How do we make money with INOWATTIO?

There are two main value streams:

- Cost Reduction / Imbalance Management: Reduce penalties/costs from deviations vs schedules by forecasting + corrective dispatch.

- New Revenue from Flexibility Markets: Get paid for providing grid services (load increase/decrease, generation curtailment, reserve, fast response, etc.) and/or optimize energy trading/arbitrage for storage.

Most clients see a mix of both.

What determines how much we can earn?

Earnings depend on:

- available flexible capacity (kW/MW you can move)

- duration (how long you can sustain it)

- response speed (seconds vs minutes)

- activation frequency (how often you’re called)

- local market design (products, prices, penalties)

- operational constraints (production boundaries, SOC limits for batteries, etc.)

- metering quality (granular measurements unlock more products)

INOWATTIO’s role is to quantify and monetize the maximum safe flexibility.

Do we earn money even if we are not dispatched?

Depending on the market/product:

- some products pay availability / capacity (paid for being ready)

- others pay activation / energy delivered (paid when dispatched)

- some pay both

INOWATTIO tracks this at event-level so revenue is attributable and auditable.

Is this “real revenue” or just savings?

Both.

- Savings: lower imbalance costs, lower demand peaks, better scheduling

- Revenue: ancillary services, balancing/flexibility programs, curtailment compensation (for generators), arbitrage profits (for batteries)

Your commercial model can be structured to reflect either or both.

What markets or programs can we participate in?

That depends on the country and your eligibility, but typically:

- balancing and ancillary services (frequency response, reserves)

- flexibility programs (TSO/DSO procurements)

- energy markets optimization (for storage: charge/discharge to capture spreads)

- congestion/voltage support where products exist

INOWATTIO is built to support multi-product optimization when the rules allow it.

Who is this for?

Typical profiles:

- Industrial consumers with flexible processes (electrolysis, furnaces, mills, compressors, refrigeration, HVAC, pumps)

- Renewable generators that can curtail on command (PV parks, wind farms, hydro flexibility)

- Battery operators (grid-scale or behind-the-meter)

- Utilities / grid operators that want a dispatchable VPP layer across distributed assets

Do we have penalties if we don’t deliver?

Some programs impose non-delivery rules (reduced payment, penalties, exclusions). INOWATTIO reduces this risk by:

- only offering flexibility that is actually feasible

- monitoring constraints in real time

- using fail-safes

- forecasting and re-optimizing to avoid impossible commitments

How do you integrate with our assets?

Common approaches:

- industry protocols (where available)

- inverter/BMS interfaces (PV, batteries)

- SCADA/EMS connections (industrial sites)

- API connectors and secure gateways

We build a “digital twin” view used for forecasting, constraints, and dispatch.